Hecheng's Dual-Country Tariff Shield

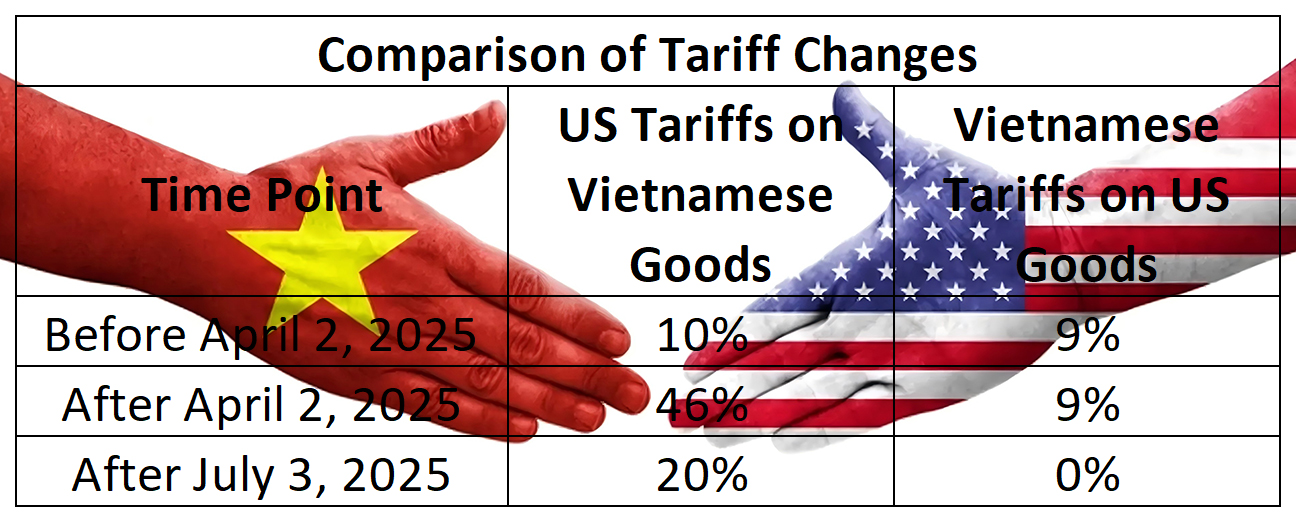

Now the U.S. implemented 30% tariffs on Chinese textile/apparel exports – with potential escalation to 54% after the 90-day (around August 15th) grace period. Simultaneously, President Trump announced a 20% baseline tariff for Vietnamese-origin goods via Truth Social on July 3rd. For bag manufacturers leveraging dual-country production models, these developments necessitate decisive strategic production shift frameworks centered on Vietnam bag production.

The Vietnamese government's proactive negotiations secured critical advantages for tariff resilience manufacturing:

★ 20% standard tariff vs. China's current 30% (+ potential 54%)

★ Avoidance of initial 46% proposals through bilateral agreements

How Fujian Hecheng Bag Manufacture & Vietnam Hecheng Enterprise Co., Ltd. Drive Uninterrupted Global Supply

For over 20 years, our China facilities anchored production – now enhanced by Vietnam bag production hubs neutralizing tariffs through strategic production shift models. This positions Hecheng not as another manufacturer, but as a geopolitical risk mitigation partner.

For U.S. Importers:

★ This tariff inflection demands immediate strategic production shift to Vietnamese facilities.

★ Leverage Vietnam's tariff resilience manufacturing advantages: 20% tariff ceiling vs China's 54%(maybe)

With Vietnam bag production now an operational imperative, Hecheng Bag Manufacture tariff resilience manufacturing solutions ensure sustainable export growth.

Forward-looking Vietnam bag production operations should implement:

1

Strategic production shift: Rebalancing US-destined orders to Vietnamese facilities

2

Localization Acceleration: Achieving higher input Vietnam localization rates for preferential tariffs

3

Price Architecture Restructuring: Collaborative margin management with U.S. importers

4

Tariff resilience manufacturing optimization: Lean offsets in Vietnam facilities